Hey there, payroll warrior! If you're diving into the world of Intuit Login Payroll, you're in the right place. This guide is your one-stop shop to master everything about logging into your Intuit payroll system, troubleshooting common issues, and maximizing its features. Whether you're a business owner, an HR pro, or just someone who wants to streamline payroll processes, this article has got your back.

Managing payroll can be a beast, but with Intuit on your side, things get a whole lot easier. Imagine having a digital assistant that handles all your payroll tasks, from employee payments to tax filings. Sounds dreamy, right? But first, you need to know how to log in and navigate the system like a pro. That's where we come in.

In this guide, we'll break down everything you need to know about Intuit Login Payroll. From setting up your account to solving login issues, we’ve got all the answers. So, grab a coffee, get comfy, and let's dive into the nitty-gritty of making payroll a breeze!

- Customer Service Number For Comed

- Dishes That Start With The Letter A

- Breastfeeding Night Sweats

- Kleiner Perkins

- Fairly Od Parents Characters

Table of Contents:

- Overview of Intuit Payroll

- How to Log In to Intuit Payroll

- Common Login Issues and Solutions

- Key Features of Intuit Payroll

- Security Tips for Your Intuit Account

- Intuit Customer Support Options

- Understanding Intuit Payroll Costs

- Intuit vs. Competitors

- Benefits of Using Intuit Payroll

- Pro Tips for Maximizing Intuit Payroll

Overview of Intuit Payroll

Intuit Payroll is more than just a tool—it’s a game-changer for businesses of all sizes. Whether you’re running a small startup or a mid-sized company, Intuit offers scalable solutions to handle payroll like a pro. The platform automates tedious tasks such as tax calculations, employee payments, and compliance reporting, freeing up your time to focus on what really matters—growing your business.

So, what exactly does Intuit Payroll offer? Think of it as your personal payroll assistant. It ensures that your employees get paid accurately and on time, while also keeping you compliant with federal, state, and local tax regulations. Plus, it integrates seamlessly with other Intuit products like QuickBooks, making financial management a breeze.

Why Choose Intuit Payroll?

- Automated tax calculations

- Easy employee onboarding

- Comprehensive reporting tools

- Secure payment processing

- 24/7 customer support

How to Log In to Intuit Payroll

Logging into your Intuit Payroll account is a breeze once you know the steps. Here’s a quick guide to help you get started:

Step 1: Head over to the Intuit Login Page. Make sure you're on the official site to avoid any phishing scams.

Step 2: Enter your email address or username and password in the designated fields. If you’re logging in for the first time, you might need to verify your identity through a security question or two-factor authentication.

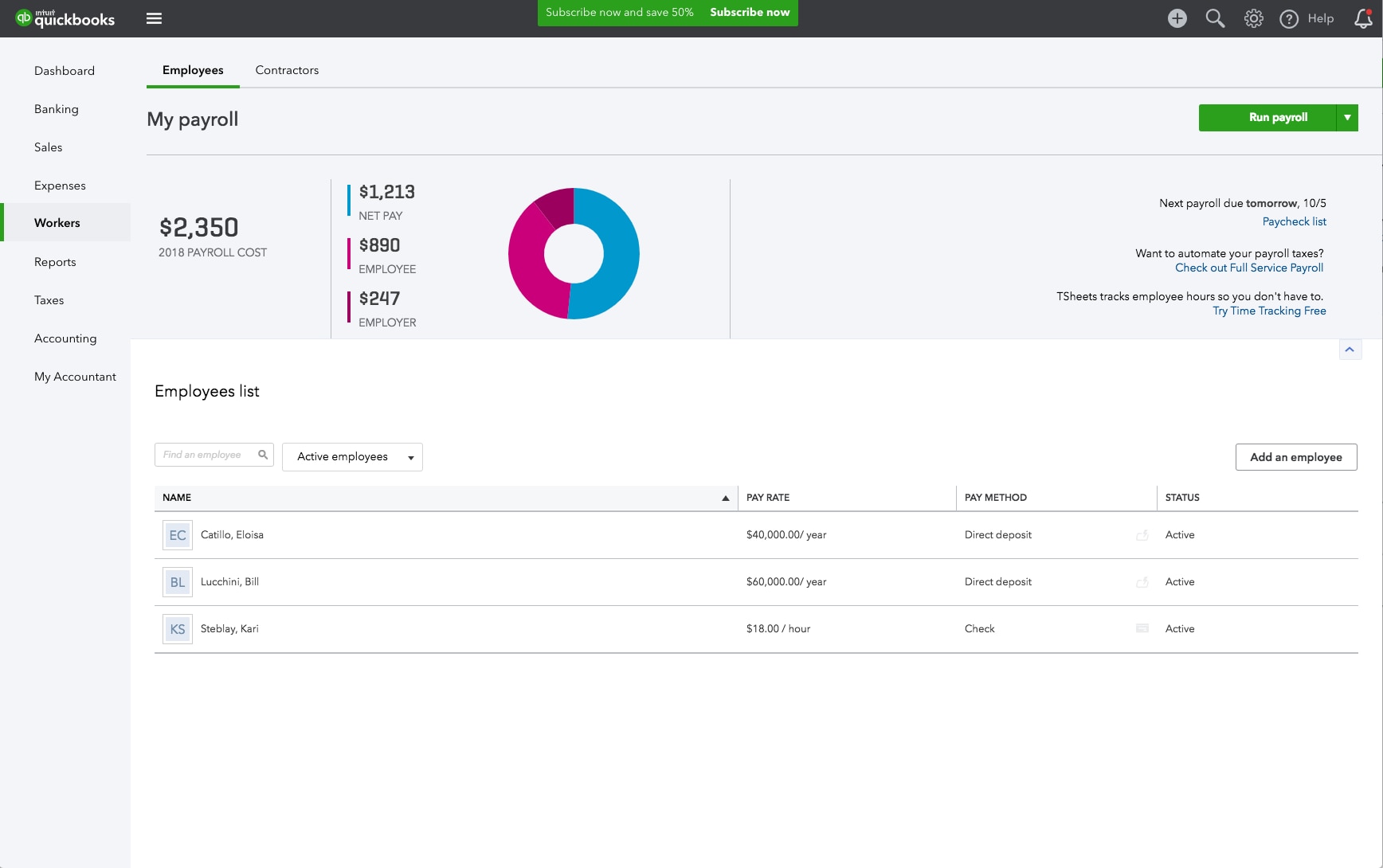

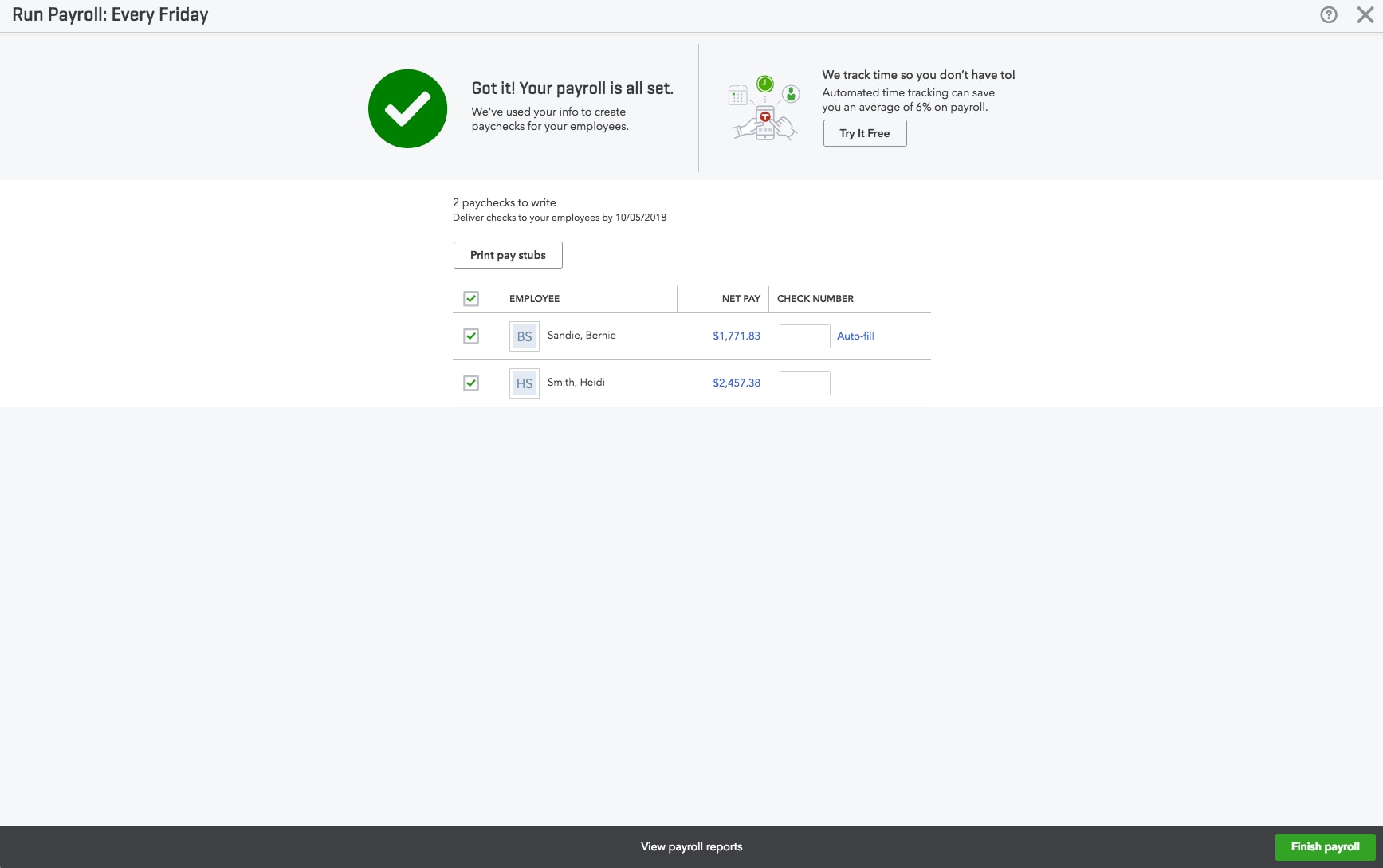

Step 3: Once you’re in, you’ll be greeted with the dashboard where you can manage everything from employee details to payroll schedules.

Tips for First-Time Users

- Create a strong, unique password to keep your account secure.

- Enable two-factor authentication for an extra layer of protection.

- Take some time to explore the dashboard and familiarize yourself with its features.

Common Login Issues and Solutions

Even the best systems can have hiccups. Here are some common login issues you might encounter with Intuit Payroll and how to fix them:

1. Forgotten Password

If you’ve forgotten your password, don’t panic. Click on the "Forgot Password" link on the login page. You’ll receive an email with instructions to reset your password. Make sure to use a strong, unique password when setting a new one.

2. Account Locked

Too many failed login attempts can lock your account. If this happens, contact Intuit customer support immediately. They’ll help you unlock your account and verify your identity.

3. Two-Factor Authentication Issues

Can’t receive the two-factor authentication code? Check your phone’s network connection or try using a backup method like a security question. If all else fails, reach out to Intuit support for assistance.

Key Features of Intuit Payroll

Intuit Payroll is packed with features designed to make your life easier. Here’s a breakdown of some of its most powerful tools:

1. Automated Tax Calculations

No more stressing over tax deadlines. Intuit handles all the calculations for you, ensuring compliance with federal, state, and local regulations.

2. Employee Self-Service Portal

Empower your employees by giving them access to their own portal. They can update personal information, view pay stubs, and manage tax forms—all in one place.

3. Direct Deposit

Say goodbye to paper checks. Intuit offers seamless direct deposit options, ensuring your employees get paid on time and hassle-free.

4. Comprehensive Reporting

Stay on top of your payroll data with detailed reports. From employee earnings to tax liabilities, you’ll have all the insights you need to make informed decisions.

Security Tips for Your Intuit Account

With so much sensitive information stored in your Intuit account, security should be a top priority. Here are some tips to keep your data safe:

- Use a strong, unique password and update it regularly.

- Enable two-factor authentication for added protection.

- Be cautious of phishing emails and only access your account through the official website.

- Regularly review your account activity for any suspicious transactions.

Intuit Customer Support Options

Need help with your Intuit Payroll account? Intuit offers a range of support options to assist you:

1. Live Chat Support

Talk to a live agent through the Intuit website. They’re available 24/7 to answer your questions and resolve issues.

2. Phone Support

Prefer a good old-fashioned phone call? Dial Intuit’s customer support number and speak to a representative directly.

3. Online Help Center

Visit the Intuit Help Center for a wealth of resources, including FAQs, tutorials, and troubleshooting guides.

Understanding Intuit Payroll Costs

Intuit Payroll offers a range of pricing plans to suit different business needs. Here’s a quick overview:

1. Basic Plan

Perfect for small businesses, this plan includes essential features like payroll processing and tax filing.

2. Enhanced Plan

For businesses that need more advanced features, this plan adds tools like employee self-service and direct deposit.

3. Premium Plan

If you’re looking for the ultimate payroll solution, this plan offers everything from the previous plans plus additional features like HR support and time tracking.

Intuit vs. Competitors

When it comes to payroll software, Intuit is up against some stiff competition. Here’s how it stacks up against its rivals:

1. Gusto

Gusto offers similar features to Intuit but focuses more on HR tools. If you’re looking for a payroll solution with a strong HR component, Gusto might be worth considering.

2. ADP

ADP is a powerhouse in the payroll industry, offering a wide range of services. However, it can be more expensive and complex than Intuit, making it better suited for larger businesses.

3. Paychex

Paychex is another major player in the payroll space. It offers robust features but can be pricier than Intuit, especially for smaller businesses.

Benefits of Using Intuit Payroll

Still on the fence about Intuit Payroll? Here are some compelling reasons to make the switch:

- Streamlined payroll processes

- Comprehensive tax compliance

- Easy employee management

- Cost-effective pricing plans

- Excellent customer support

Pro Tips for Maximizing Intuit Payroll

Ready to take your Intuit Payroll experience to the next level? Here are some pro tips to help you get the most out of the platform:

- Set up automated payroll schedules to save time and ensure timely payments.

- Regularly review and update employee information to keep everything accurate.

- Take advantage of the employee self-service portal to reduce administrative workload.

- Use the reporting tools to gain insights into your payroll data and make informed decisions.

Final Thoughts

Managing payroll doesn’t have to be a headache. With Intuit Payroll, you can simplify the process and focus on growing your business. From easy login to powerful features and excellent customer support, Intuit has everything you need to succeed.

So, what are you waiting for? Dive into the world of Intuit Payroll and experience the difference it can make. And don’t forget to share this article with your fellow payroll warriors!

- German Shepherd Rottweiler Pitbull Mix

- Jlo Pregant

- Gibby From Icarly

- Consulado De M%C3%83 Xico En Seattle Seattle Wa

- Can Chase Bank Exchange Foreign Currency